Key Takeaways

- Recognizing an industry's life cycle stage helps finance, investment and consulting professionals tailor strategies to leverage opportunities or manage risks.

- Understanding industry growth, maturity and decline enables better resource allocation and decision-making for lasting profitability.

- Financial institutions and investors can use life cycle stages to craft effective lending and investment strategies suited to client needs.

Understanding an industry’s life cycle stage has become essential to making informed strategic decisions. Each life cycle stage—whether growth, maturity, or decline—has a unique impact on profitability and competitive positioning, influencing everything from resource allocation to market entry. The concept of industry life cycles, a framework that has guided companies for decades, offers significant insights for today’s business professionals.

Harvard Business School professor Michael Porter highlighted the importance of industry context, noting its substantial influence on profitability. Porter’s research revealed that a company’s performance is not solely a function of its own strategy but also of the environment in which it operates. Industry context and benchmarks thus play a defining role in shaping business potential, affecting financial institutions, investors and consultants in particular as they seek to align strategies with an industry’s trajectory.

The fundamentals of industry life cycles

An industry life cycle outlines the progression of an industry from its inception to its eventual decline, serving as a framework that guides business strategies and financial decisions along the way. This cycle significantly affects company performance, as each stage presents distinct risks and opportunities that businesses must navigate. Typically, industries progress through the growth, maturity, and decline stages, with each phase bringing varying levels of demand, competition, and profitability.

While life cycles have been relatively consistent in the past, they are now increasingly influenced by accelerating forces such as technological advancement, globalization, and shifts in consumer behavior.

For instance, technological innovations can disrupt traditional business models, offering new ways to deliver products or services and potentially extending an industry's growth phase. Similarly, globalization opens new markets and competitive dynamics, altering the landscape in which companies operate. Shifts in consumer preferences can also rapidly transform industry trajectories, either prolonging growth or hastening decline, thus altering the duration and characteristics of each phase.

Understanding where an industry stands within its life cycle is crucial for business professionals to anticipate challenges and prepare strategies that capture emerging opportunities. Analyzing the life cycle informs decisions on entering or exiting markets, restructuring resources, or investing in innovative initiatives that align with an industry’s current needs.

By tracking these cycles, professionals can tailor their approaches to meet evolving market demands, ensuring that they remain competitive and responsive to change. Companies that pay attention to these cycles are better positioned to mitigate risks and leverage opportunities, securing their place in the market for the long term.

The stages of an industry life cycle

The industry life cycle generally consists of three main stages: growth, maturity, and decline. Each stage has specific characteristics that shape strategic decisions, impacting everything from market expansion to consolidation.

Growth

The growth stage indicates that the industry is growing faster than GDP, characterized by rapid increases in demand, innovation, and the emergence of numerous new entrants. During this stage, companies are in a race to establish themselves and capture significant market share. Revenue growth during this period is often substantial, as products and services gain popularity and reach a larger customer base eager for novel offerings. The influx of new companies and startups fuels intense competition, driving innovation as businesses seek to differentiate themselves and stand out in a crowded market. This dynamic environment fosters creativity and the development of innovative solutions to meet evolving consumer needs and preferences.

Quantity vs. Quality Growth

Within the growth stage, two distinct phases emerge, each with its own strategic focus. The early phase emphasizes “quantity growth,” where companies prioritize rapid expansion to secure a larger piece of the market and attract a greater number of customers.

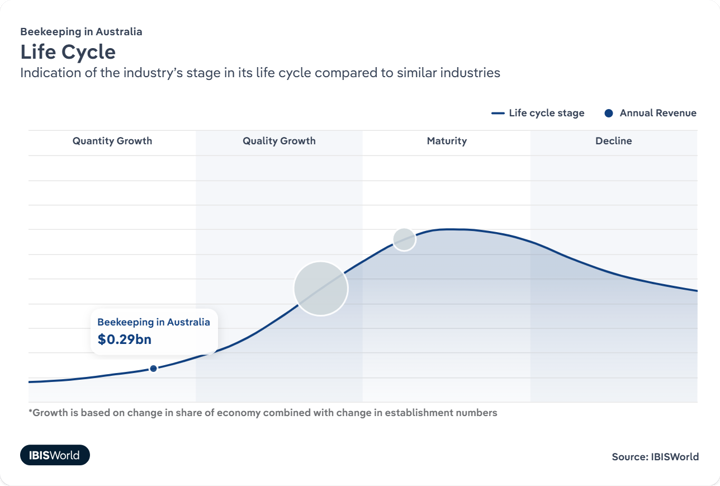

This expansion often involves scaling operations, increasing production capacity, and investing heavily in marketing efforts to maximize reach and visibility. As an example, the beekeeping industry in Australia is in the quantity growth stage.

As the industry matures and stabilizes, the emphasis gradually shifts toward “quality growth.” In this more refined phase, firms aim to improve product quality, enhance the user experience, and strengthen their brand identity. This shift reflects an evolving focus on retaining customers and building long-term value, rather than merely expanding reach. Companies invest in research and development, customer centricity and feedback mechanisms to ensure that their offerings meet and exceed consumer expectations.

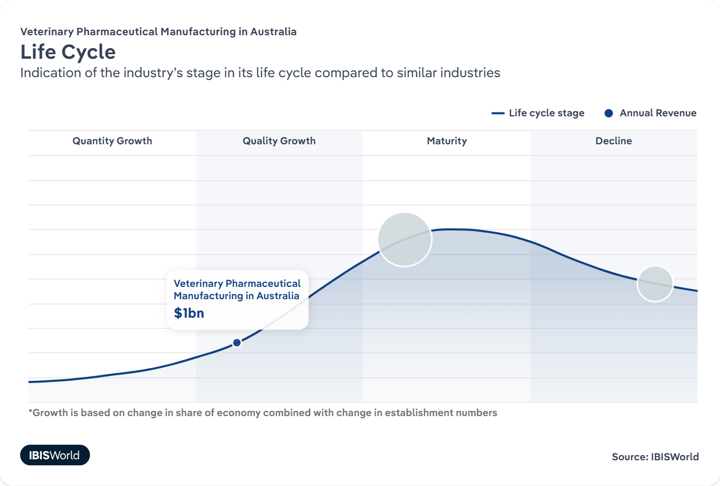

This strategic transition is essential for sustaining growth and ensuring the long-term success of businesses in a competitive marketplace. For instance, the veterinary pharmaceutical manufacturing industry in Australia is in the quality growth stage.

Maturity

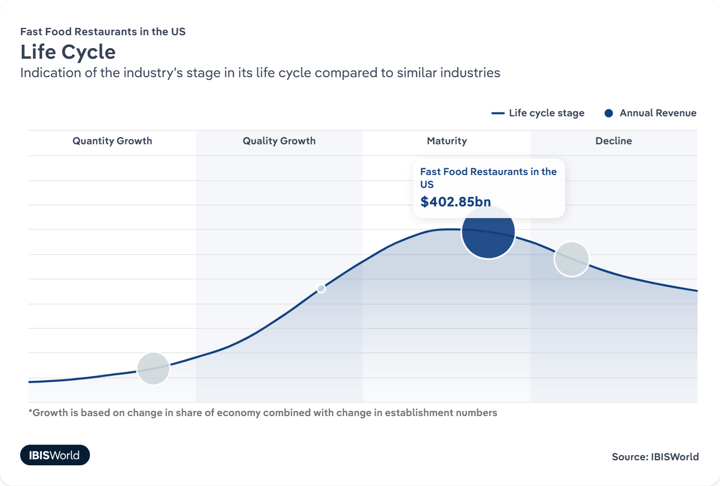

As industries reach the maturity stage, growth stabilizes and aligns more closely with the overall economy, given that the industry grows at the same rate as GDP. For example, the well-established fast food restaurant industry in the US is in the mature stage.

During this phase, market saturation becomes increasingly evident, as the majority of consumers who desire the product or service have already entered the market, leaving few untapped opportunities.

This saturation leads to intensified competition, prompting a wave of market consolidation, where dominant players absorb smaller firms or force them out of the market. As the competitive landscape becomes more challenging, innovation tends to slow down Companies prefer to prioritize efficiency, cost management and customer retention over the development of new products or services.

In the maturity stage, businesses focus on refining processes, maintaining operational efficiency, and enhancing their market position. Strategies are centered around optimizing existing assets, protecting market share and differentiating products to stand out in a crowded and competitive landscape.

This stage represents a period of stability but requires ongoing adaptation and strategic planning to sustain relevance and competitiveness. Firms must evaluate their operations and market strategies to ensure they can meet evolving customer needs and respond to emerging market trends, ultimately securing their place in the industry for the long term.

Decline

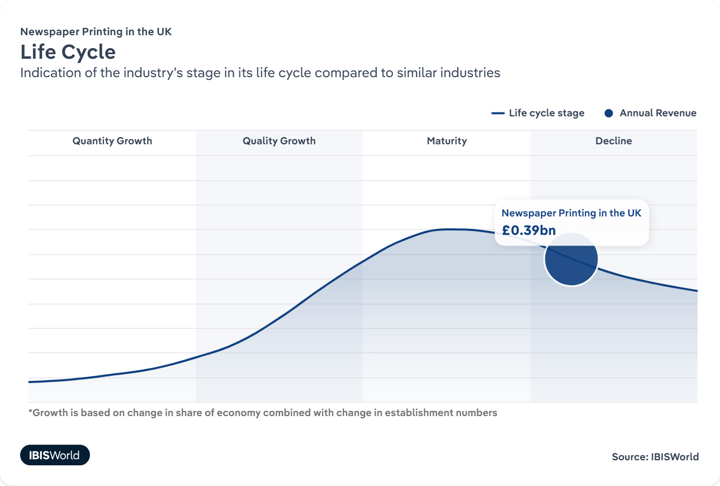

The decline stage indicates that the industry is declining faster than GDP. This weakening is often caused by various factors including reduced consumer demand, technological obsolescence, or the emergence of new and compelling alternatives. For example, the newspaper printing industry in the UK is in its decline stage.

As demand for products or services wanes, competition within the market becomes more intense and companies face the challenge of maintaining profitability amidst weakening sales. This stage compels businesses to adapt to these changing dynamics by implementing strategies such as cost management, restructuring operations, or even considering exiting the market if necessary.

In the decline phase, companies often shift their focus toward risk management and consolidation. The primary goal is to extract as much value as possible from their existing assets while maintaining financial stability. For some firms, mergers and acquisitions offer a viable path to survive in a shrinking market, allowing them to tap into new resources and markets. Others may choose to pivot toward new products or services, aiming to regain relevance and capture emerging opportunities.

The strategic emphasis during this stage is on managing risk effectively, maximizing operational efficiency and reducing exposure to failing or underperforming assets. Navigating the challenges of a declining industry landscape calls for thoughtful planning and meticulous execution.

Identifying life cycle indicators

Understanding the stage of an industry’s life cycle is essential for professionals aiming to offer valuable insights into current market conditions and guide strategic choices for businesses. Four primary indicators provide a comprehensive framework to identify these stages effectively.

Product performance

Evaluating the quality and relevance of products within the market is crucial in determining the life cycle stage. High-performing, innovative products frequently signal a growth phase, as they capture consumer interest and drive sales momentum. These products often incorporate the latest technologies or meet unmet consumer needs, fostering a competitive edge.

Conversely, if products appear stagnant, outdated, or are not meeting consumer expectations, it may indicate the market is entering a maturity phase. As consumer demand diminishes over time, this stagnation could even suggest a potential decline, urging companies to innovate or risk obsolescence.

Number of enterprises

The number of active companies within an industry serves as a significant indicator of the industry’s life cycle stage. An increasing number of new entrants into the market suggests that it is both growing and potentially lucrative, attracting entrepreneurs and investors eager to capitalize on emerging opportunities. This influx often leads to heightened competition and innovation as companies vie for market share. On the contrary, market consolidation, where fewer companies dominate and smaller ones are either absorbed or pushed out, typically indicates maturity or decline. This reduction in competition occurs due to market saturation or financial challenges that only the most robust companies can withstand.

Technological change

Assessing the pace and impact of innovation within the industry provides insights into its current and future dynamics. Industries in the growth stage often experience rapid technological advancements, leading to the continuous development of new products and the improvement of existing processes. Such innovations not only fuel growth but also attract new customers and markets. As the industry progresses towards maturity, the rate of technological change may slow. This slow down suggests market stabilization. A potential decline might be signaled if innovation no longer drives consumer interest or differentiation, prompting businesses to rethink their competitive strategies.

Market acceptance

The level of acceptance and adoption of products or services by consumers is reflective of the industry’s standing. Strong acceptance, characterized by high adoption rates, customer loyalty, and positive consumer feedback, generally indicates a mature market. This maturity often results from a deep understanding of consumer needs and the development of products that effectively meet these demands. However, if there is noticeable resistance to new products or a declining interest in existing offerings, it suggests that the market may be in decline. This decline should prompt businesses to reconsider their strategies, possibly redirecting focus towards innovation, diversification, or repositioning to regain consumer interest and market vibrancy.

How each life cycle stage influences business strategy

Understanding an industry's life cycle stage can unlock a wealth of knowledge and strategic advantages. Navigating an industry effectively requires a deep understanding of its unique characteristics, and, without this insight, investors and managers may struggle to exploit opportunities or even survive in the broader business environment.

Growth stage strategies

During the growth stage, businesses focus on rapid expansion, capital raising and innovation. This phase offers high-potential opportunities, though with greater risk. Companies aim to scale quickly, establish brand presence and invest in R&D to stand out in a crowded market. Growing industries, often in 'new economy' sectors, are hungry for resources and services, from capital to fund wages and goods to marketing and consulting services. Finance professionals play a critical role by assessing credit risk and supporting growth through strategic financing.

Maturity stage strategies

As industries mature, strategies shift toward differentiation, international expansion and consolidation. Market leaders focus on enhancing customer experience and refining operations to safeguard their market position. Mature industries growing at about the same rate as GDP seek business advice for marketing and product branding. Companies will require professional services to reposition products or expand into foreign markets, with increased demand for valuation, investment banking and consulting as consolidation intensifies.

Decline stage strategies

In a declining industry, managing risk, maximizing value and considering mergers or acquisitions are key to survival. Strategies emphasize cost efficiency, product differentiation and streamlining operations. Decline is the riskiest life cycle stage, requiring careful management to avoid over-investing in a contracting market. Industries in decline often see severe consolidation and changes in demand. Surviving companies must adapt their products, markets or technology. These companies seek assistance in managing risk, using healthy profit margins to invest in product and process development to extend the industry life cycle. Demand for banking services rises as companies seek to revitalize their products and brands.

Strategies for success for consultants and business strategists

- Use industry research and life cycle insights to guide clients on growth opportunities, competitive risks, and market stability at every stage.

- Optimize client resource allocation by tailoring investment in innovation, operational efficiency and market retention strategies based on the industry's life cycle stage.

- Position clients to adapt smoothly to life cycle transitions, ensuring proactive strategies that maximize growth potential and minimize risk through each industry phase.

How industry life cycles affect finance

Financial institutions play a vital role in supporting businesses across each life cycle stage, from startup to maturity through periods of decline or restructuring. By understanding the unique needs and challenges faced at each stage, these institutions can provide targeted financial services and risk assessments. Tailoring their offerings to address the specific challenges and opportunities of each phase not only enables institutions to better serve their clients but also helps them optimize outcomes, ensuring sustainable growth and stability for businesses.

This proactive and adaptable approach benefits both the financial institutions and the businesses they support, fostering a mutually beneficial relationship.

Strategies for success for commercial bankers:

- Use industry life cycle data to refine lending criteria, improving risk management and credit assessments.

- Develop customized financial products for each life cycle stage, such as flexible credit lines for growth-stage businesses needing rapid capital.

- Provide strategic advice to clients in mature or declining sectors to help them strengthen their market positioning.

Strategies for success for investment bankers:

- Adapt valuation models to align with life cycle factors, providing accurate valuations for acquisitions or investment deals.

- Tailor M&A strategies to industry maturity, with a focus on supporting clients through strategic consolidations.

- Guide clients towards high-growth sectors and assist with consolidation or restructuring in declining markets.

Final Word

The industry life cycle offers a powerful framework for enhancing strategic and financial decision-making. Understanding an industry’s position within this cycle enables professionals to anticipate challenges, capitalize on emerging opportunities, and make informed choices in planning, lending, and investing. By tailoring strategies to each life cycle stage, finance and investment professionals can empower businesses to drive growth, sustain profitability and navigate risks effectively, ultimately fostering resilience and competitive strength.