Key Takeaways

- Integrating ESG into core business strategy drives long-term growth and resilience, building trust with investors and consumers.

- Setting SMART ESG goals using reliable industry data helps businesses navigate regulatory changes while building a competitive edge.

- A sustainability-focused culture transforms ESG challenges into opportunities, improving both financial performance and brand reputation.

Picture this: I'm comfortably nestled in a bustling café in London, sipping a flat white, when the newsflash hits me. There it was; "Patagonia's Profit Surge Spurs Rivals to Embrace ESG." Naturally, I wanted to know more.

Patagonia's ESG prowess originated from its move to pledge 1% of its sales to environmental causes, co-founding the "1% for the Planet" alliance. But what really made an impact? Their ability to turn these ESG efforts into tangible business success. From reducing waste through their Common Threads Initiative to creating Patagonia Provisions, a sustainable food line, they embraced sustainability at every level of their operations. These efforts resulted in quadrupling Patagonia’s sales over the last decade, as well as building a loyal customer base that values the company’s commitment to ESG.

This story got me thinking about my own work in ESG. Having helped businesses benchmark their ESG performance through risk reports, I’ve seen firsthand how companies like Patagonia don’t just view ESG as a box-ticking exercise but as a foundation for growth. From what I’ve observed, integrating these values into a company’s strategy is imperative for earning trust from both investors and consumers, while driving success.

So, clearly ESG isn’t just a corporate buzzword. It has evolved into a strategic tool for driving responsible business practices that lead to profitability and long-term resilience. The world is witnessing tightening regulatory requirements and stakeholders are demanding more transparency and sustainability from the brands and investments they support.

Companies, big and small, must align with these trends or risk being left behind. There’s no more room for greenwashing: consumers and investors are smarter and more informed than ever before. The question is, how can your business leverage this momentum to achieve strategic success?

A critical component of modern strategic planning

The three pillars of ESG have steadily seeped into policy, with many countries implementing regulations to promote transparency and sustainability. The Financial Stability Board (FSB)’s Task Force on Climate-related Financial Disclosures (TCFD), launched in 2015, has influenced global standards for reporting climate-related financial information.

Countries like the UK have followed suit with mandatory ESG and climate change disclosures through the Financial Conduct Authority (FCA) and initiatives like the Energy Saving Opportunity Scheme (ESOS), which requires energy assessments for large businesses. In Australia, the government has introduced mandatory climate-related reporting requirements for large companies under the Treasury Laws Amendment Bill 2024. The US has also seen the passing of the Inflation Reduction Act (IRA) back in 2022, aimed at decarbonizing the economy.

Investors push ESG as a growth driver

As global ESG-focused policies gain traction, it’s not just consumers holding companies accountable—investors are increasingly scrutinizing businesses for their ESG commitments. The financial world has recognized ESG as essential for driving value creation. A Bloomberg Intelligence report found that 85% of investors believe ESG leads to better returns, resilient portfolios and stronger fundamental analysis.

Major investors are now incorporating ESG performance into their decision-making process. BlackRock, the world’s largest asset manager, is a key example—demanding that companies not only disclose but actively improve their environmental and social impact to align with investment goals.

As ESG assets surpassed $30 trillion in 2022 and are projected to exceed $40 trillion by 2030, businesses that fail to integrate ESG risk losing investor confidence and facing higher capital costs. Investors have shifted from being passive stakeholders to becoming active drivers of change, pushing companies to meet and exceed ESG benchmarks in their industries.

Aligning ESG principles appeals to the growing pool of ESG-conscious investors, positioning your business as a leader in sustainability and ethical practices. The takeaway for businesses is clear: neglect ESG, and you risk being left out of the investment portfolios that matter most.

Maximizing ESG strategy with industry research

So, where does industry research factor in? Well, it can help with all matters related to ESG. Companies can use industry research to inform strategic initiatives by tapping into ESG insights on consumer and business attitudes across an industry. This includes zooming in on a company's regulatory environment, assessing upcoming policy changes and benchmarking ESG scores and practices against an industry's average. But before setting an ESG goal, it’s essential to focus on what ESG factors resonate with your business’s mission. For instance, if you’re in construction, this could involve reducing carbon emissions through sustainable materials or minimizing waste on job sites. In banking, it could mean promoting financial inclusion or implementing responsible lending practices.

Using internal insights and external data

Once you've nailed that down, you need to gather internal ESG data. Think of it as your performance scrapbook, providing a snapshot of where you've been and where you are now. This could include metrics on energy usage, waste production, employee demographics, labour practices, governance policies and other operational aspects. After that, you’ll need external data to gain a broader perspective.

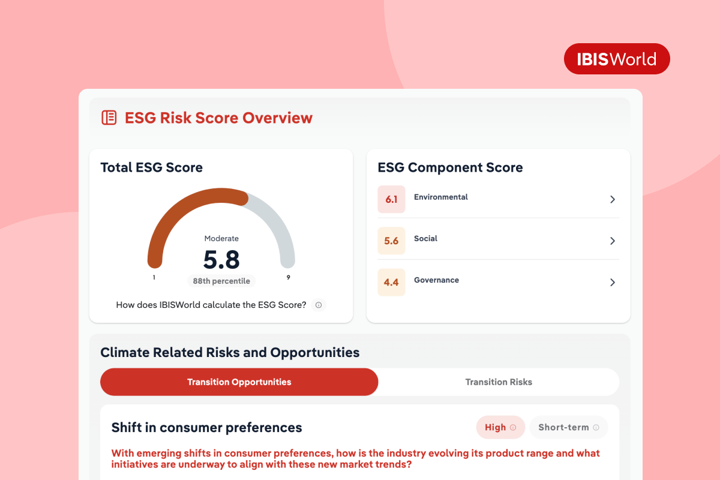

During my time working on ESG risk reports, we saw firsthand how valuable industry research is in shaping a company’s strategy. External data provides context—benchmarking ESG performance against competitors, identifying regulatory risks and offering insights into the practices of major industry players.

For example, while helping to compile our risk reports, I worked with datasets covering everything from carbon emissions to gender pay gaps. This data helped businesses understand where they stood in terms of ESG performance, physical risks, transition risks and transition opportunities, all while giving them the tools to identify areas for improvement.

These insights allowed these companies to go beyond simply reacting to ESG trends. Now they are able to anticipate challenges and position themselves as leaders in sustainability. Instead of treating industry research as a simple checklist item, companies use it as a building block to develop well-informed ESG strategies. By grounding these strategies in accurate, up-to-date data, businesses can make smarter, long-term decisions rather than just reacting to trends or regulatory changes.

Banking on ESG

Imagine you’re meeting with a small business client—a manufacturing company that’s been around for decades. ESG? That’s uncharted territory for them. They’re good at what they do but haven’t considered how sustainability fits into their business. For many in their position, ESG feels like something for the big leagues, something they’ll “get around to” when it’s more convenient. But this is precisely where advisors can step in and change the narrative.

One banking client I worked with had a similar experience. They started using ESG assessments not just to gauge compliance but to really understand their clients’ industries and the broader risks they face. By comparing a small manufacturer’s ESG performance against industry benchmarks, the advisory team uncovered potential risks that weren’t visible on the surface—like supply chain vulnerabilities linked to outdated environmental practices. This insight wasn’t just theoretical; it allowed the bank to have a more strategic conversation with the client, helping them identify areas to improve and avoid potential pitfalls that could impact their operations down the line.

This approach helped the bank refine its lending strategy. Instead of viewing ESG as a checkbox, they started using these insights to identify borrowers who were actively managing sustainability issues—companies that weren’t just talking about ESG but were putting it into practice. This not only reduced the bank’s exposure to high-risk loans but also positioned them as partners invested in their clients' success. And for the clients, this was a wake-up call. With clear, actionable insights, they were better equipped to take meaningful steps forward, aligning with sustainable practices and enhancing their credibility in the eyes of investors, regulators, and customers alike.

It’s a win-win. For banks, it’s about lending to the right players and strengthening their portfolio. For businesses, it’s about staying ahead of the curve and demonstrating they’re ready to compete in a world where sustainability is no longer optional—it’s essential.

How to make ESG a core part of your strategy

Aligning your business with ESG goals through industry research is a critical first step, but the key to fully embedding ESG into your strategic initiatives is making sure that these goals are directly aligned with your core business strategy. ESG shouldn’t sit separately, it has to be woven into the fabric of your overarching objectives. Whether you’re expanding your market share or innovating products, sustainability can strengthen your competitive advantage, creating stronger alignment with investor expectations and consumer demand.

But how do you take the next steps to fully embed ESG into your strategic initiatives?

Set SMART, actionable goals

The first step is to set SMART goals—Specific, Measurable, Achievable, Relevant and Time-bound. It’s not enough to simply aim for sustainability, as stakeholders expect tangible, accountable change. For example, a goal like reaching net-zero emissions by 2050 requires clear steps and a structured plan to achieve it.

From my experience working alongside various companies, I've seen firsthand how ESG benchmarking can guide businesses in setting clear objectives. Using quantifiable, up-to-date and reliable ESG data allows companies to build a dependable strategy, improving risk management and driving sustainable growth.

Regularly revisiting ESG benchmarks helps companies refine their approach, ensuring they stay aligned with industry standards and ahead of emerging trends. Whether the goal is to reduce carbon emissions or improve social equity metrics, it’s essential that these goals are based on accurate benchmarks and tailored to the specific needs of the industry.

Checklist for achieving your goals

To effectively integrate ESG into your strategy, setting clear and actionable goals is essential. Use this checklist to make sure your goals are aligned with your sustainability mission, are practical and achievable:

- Define a clear, specific objective: For example, your business could aim to reduce carbon emissions by 20% over three years.

- Ensure it's measurable: Track key metrics like energy usage, waste output or the carbon footprint of your company’s operations.

- Make it achievable: Set realistic targets based on current data and industry standards.

- Keep it relevant: Align the goal with your business strategy, such as adopting a low-carbon supply chain or switching to hybrid vehicles, which resonates with your client base.

- Time-bound commitment: Set a definitive timeline, such as reducing emissions by 6.3% annually to meet 20% over three years.

Build a culture of sustainability

But here's the pièce de résistance: creating a sustainability-focused culture is what brings your ESG strategy to life. When leadership prioritises sustainability, it inspires the entire team to commit to greener practices. Your eco-champions will inspire the whole team to hop aboard the green train.

Host events, run workshops and get creative with them. Sustainability should be exciting and caveated with regular updates and monitoring. The business landscape and regulatory environment change like the British weather, so staying in the loop with the latest trends and green opportunities is paramount.

From sustainability goals to industry leadership

I recall working with a packaging company that faced a crossroads—stick with business as usual or fully commit to sustainability. They chose the latter and made ESG more than just a side project; it became the core of their strategy. The turning point came during a conversation with their advisory team, where they realized that staying competitive in the long run meant embracing the circular economy. The challenge? Figuring out how to reduce waste and keep materials in circulation while adapting to new sustainability standards.

The company didn’t stop at setting broad sustainability goals. They constantly reviewed their progress, identifying trends in sustainable materials and tweaking their approach to meet shifting regulations. I remember their leadership team discussing how they started by focusing on reducing specific types of packaging and emissions, then expanded to building partnerships with suppliers who specialized in recycled content. They even brought labour practices into the mix, ensuring their entire value chain was aligned with ESG principles.

What really stood out was how agile they became. As new challenges surfaced, they adapted quickly, refining their strategy to stay ahead. This flexibility didn’t just improve their environmental footprint—it transformed their brand. Suddenly, they were the go-to choice for environmentally conscious consumers, with customers praising them for their commitment to real change, not just lip service. Stakeholders, too, took notice, seeing them as a leader in the industry.

Turning ESG challenges into opportunities

Integrating ESG objectives into strategic planning is undoubtedly tricky, and companies need help with a sea of ESG planning challenges. Many businesses face common obstacles that can seem daunting, from balancing immediate financial pressures to managing complex data.

However, these challenges also present significant opportunities for growth, innovation and long-term resilience. Let’s take a closer look at some of the key challenges and how to overcome them effectively:

Managing the costs of ESG implementation

ESG initiatives often come with upfront costs, such as adopting new technology or changing operational practices, particularly burdensome for smaller companies.

Solution

Start with smaller, incremental steps. For example, implementing cost-effective, scalable tools for tracking energy usage or waste management. Gradually increase investment as you see the returns from these initiatives. Industry research can also help identify the most impactful areas to start, ensuring that early investments lead to long-term gains.

Navigating complex and changing regulations

The regulatory landscape around ESG is constantly shifting, making it difficult for companies to stay compliant, especially those with limited resources.

Solution

Stay proactive by setting up regular regulatory reviews and audits. Use industry research to keep up-to-date on new regulations, and consider engaging third-party auditors to ensure compliance. Proactive compliance can turn regulatory hurdles into strategic advantages, building trust with investors and consumers alike.

Avoiding greenwashing

In the rush to appear environmentally responsible, some businesses exaggerate their sustainability claims, risking reputational damage when they can’t back them up.

Solution

Transparency is key. Make sure your ESG goals are measurable, realistic, and publicly reported. Regularly audit your practices, and use third-party certifications to verify your claims. Authenticity will help you build credibility and trust with stakeholders.

Gaining buy-in from stakeholders

ESG initiatives often require buy-in from both internal and external stakeholders, who may be hesitant about the cost or relevance of sustainability efforts.

Solution

Foster a sustainability-focused culture from the top down. Leadership needs to champion ESG efforts and communicate the benefits to both employees and shareholders. Hosting workshops, providing regular updates, and showcasing successful ESG initiatives can encourage broader support.

Managing data across multiple ESG metrics

Tracking a wide range of data, from carbon emissions to labour practices, can be overwhelming without the right systems in place.

Solution

Use ESG management software or platforms that centralize and automate the data collection process. These tools can help you easily track progress, ensure accurate reporting, and identify areas that need improvement.

Tracking industry and sector risk ratings

Every industry has unique risks and opportunities related to ESG factors. Understanding the specific risks in your industry or sector is imperative to navigating the broader landscape and staying ahead of emerging challenges.

Solution

Leverage tools that provide detailed risk ratings and benchmarks for your industry. By using ESG data platforms, you can monitor how your sector performs on critical ESG metrics and adjust your strategy accordingly to mitigate risks and capitalize on opportunities. This ensures your business stays aligned with best practices and competitive in the marketplace.

Final Word

Why react to change when you can anticipate it? Industry research allows you to stay ahead of the curve, aligning your strategic initiatives with changing ESG priorities. By keeping up-to-date with sector trends and benchmarks, you can seamlessly integrate ESG factors into your core business strategy, ensuring lasting success.

Take a page from Patagonia's playbook. They didn't just talk the talk; they walked the walk and it paid off. Begin by conducting thorough industry research, set SMART ESG goals and embedding them into your core strategies with full leadership support. The results? Greater resilience, stronger brand loyalty and a positive impact on the planet and your bottom line.

Want to find out more about IBISWorld's comprehensive ESG research solutions? Click here.