Key Takeaways

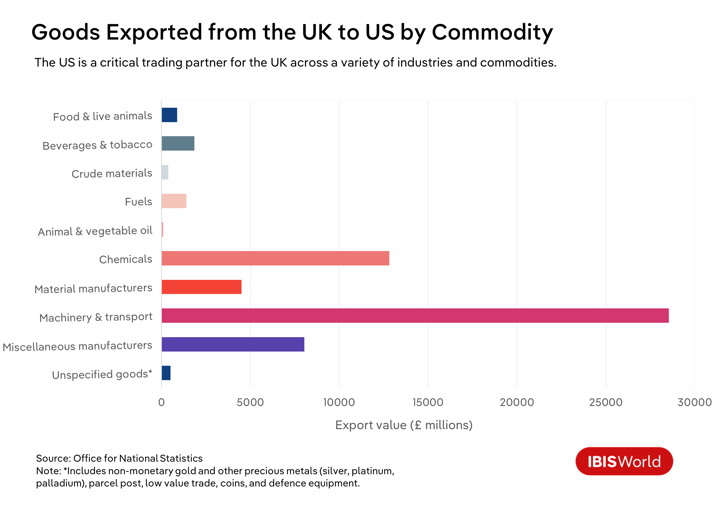

- Trump’s proposed tariffs on UK imports could lead to a £22 billion drop in global UK exports and a 2.5% reduction in UK GDP within three years.

- Key sectors will face rising costs and reduced competitiveness, prompting the need to explore strategies like diversifying export markets, relocating production, and investing in value-added processing.

- Strengthening EU trade ties and focusing on high-growth regions like Asia can help UK industries offset tariff impacts.

Just over one week into the second Trump administration, the threat of sweeping tariffs looms large as President Trump has vowed to implement this part of his agenda quickly. With America being the UK's largest trade partner, this rhetoric is already creating a wave of doubt and uncertainty throughout the economy. For the UK, the fallout is already casting long shadows over industries reliant on US trade.

The implications are massive: UK exports to the US face steep price hikes, threatening competitiveness in critical sectors like pharmaceuticals, automotive, chemicals, and mining. Add to that the ripple effects on supply chains, exchange rates, and global trade dynamics, and it’s clear the UK economy could be facing a perfect storm – with some reports suggesting UK exports could drop by £22 billion (a 2.6% decline) under the new tariffs

Can British industries rise to the challenge and pivot their strategies to weather this storm—or will these tariffs carve deep scars into the UK economy? Let’s explore the stakes, the strategies and what’s next for the UK industries set to be most impacted by these developments.

US tariffs on UK pharmaceuticals: A prescription for trouble?

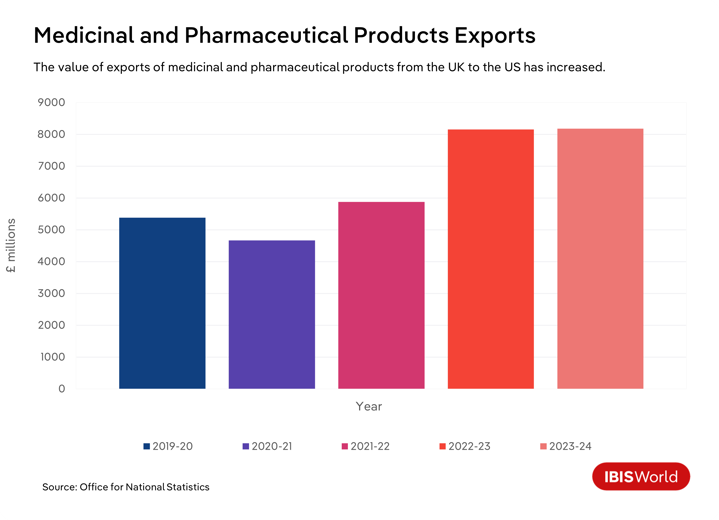

The United States dominates the pharmaceutical market, accounting for more than half of basic exports and standing as the largest and most profitable pharmaceutical market globally. Sales to the US are critical for medicinal and pharmaceutical manufacturers looking to recoup the substantial investments required for drug development. In fact, pharma companies can command significantly higher prices in the US than in Europe or other regions of the world. One key reason is that European national health authorities negotiate drug prices with manufacturers, whereas in the US, manufacturers set the prices, which are largely accepted without negotiation.

Given the importance of the US market for pharmaceutical companies, higher tariffs on UK pharmaceutical products entering the US could make UK-made drugs more expensive than their US-produced counterparts. This would likely reduce demand for UK exports, threatening sales and market share in one of the world's largest healthcare markets.

Additionally, the pharmaceutical industry heavily depends on rigid, specialised supply chains involving intermediate goods and critical minerals. As of 2024, 60-80% of Active Pharmaceutical Ingredients (APIs) used in medicine sold in Europe are produced in India and China. For UK pharmaceutical companies sourcing key ingredients and APIs from international markets, higher US tariffs on imports from countries like China could significantly increase supply costs. If Chinese API sellers raise prices for other countries to offset demand loss from the US, UK manufacturers—who rely heavily on China for API supplies—would face higher costs, intensifying price competition and eating into profit margins.

Can UK car manufacturers survive Trump’s tariff storm?

The UK car manufacturing industry plays a vital role in the economy, exporting £7.5 billion worth of cars to the US in the year through Q2 2024 and supporting thousands of jobs. Exports are the backbone of the industry, with 77% of cars produced being exported in the 11 months to November 2024. In the first half of 2024 alone, 15.4% of all vehicle exports were destined for the US. However, the Trump administration’s proposed tariffs on UK imports could pose a significant threat, potentially making UK cars far less competitive in the US market.

During his election campaign, Trump suggested even steeper tariffs—up to 100-200% on imported vehicles—raising concerns for the global EV market. Paul Hollick, chair of the Association of Fleet Professionals (AFP), shared his concerns about the challenges of selling imported cars in the US under such tariffs. He also noted the potential for automakers to shift production to the US to circumvent the duties. Additionally, Hollick warned that high tariffs on Chinese EVs may push these vehicles into freer markets like the UK, delivering further competition and disrupting the domestic market.

During Trump’s previous administration, similar trade policies compelled many UK manufacturers to rethink their export strategies. For example, Jaguar Land Rover (JLR) responded by increasing its focus on EU and Asian markets to mitigate the risks posed by US policy uncertainty. The BBC reported in 2018 that JLR’s US sales were impacted by consumer uncertainty stemming from import duty changes and escalating trade tensions between the US and China. At the time, JLR cut production at two plants and laid off agency staff to adapt to the challenging conditions.

The ripple effects of tariffs on UK chemical exports

The UK Chemical Manufacturing Industry finds itself at a critical crossroads. With the US accounting for 24% of chemical exports from the UK, the absence of a free trade agreement poses significant risks. Potential tariff hikes under the Trump administration could have a substantial impact, highlighting the need for the UK Government to address both the impact of higher US tariffs and the effects of Chinese products seeking alternative markets.

The global chemicals market is dominated by China, which produces 33.6% of the world’s chemicals, and India, whose market share is projected to grow from 3.7% to 4.4% by 2028 due to access to critical minerals. For UK manufacturers, the lack of free trade agreements (FTAs) with these nations exacerbates the situation, even though tariffs on chemical products remain relatively low (averaging under 5%). Additionally, non-tariff barriers, such as market access restrictions and complex regulatory requirements, continue to hinder the growth of UK manufacturers and their ability to tap into emerging opportunities. For example, the UK demands strict compliance with Good Manufacturing Practices (GMP) as set out by the Medicines and Healthcare Products Regulatory Agency (MHRA). Indian manufacturers must meet these standards to export APIs. Variations in the interpretation and implementation of GMP can cause delays or additional costs if Indian manufacturers are required to upgrade their facilities or alter processes.

For the UK chemical sector to remain resilient and competitive, businesses and policymakers must work together to address these structural challenges. Strategies should include negotiating improved trade terms, fostering innovation in value-added chemical products, and strengthening relationships with high-growth markets like Asia and the EU. These steps will be vital in ensuring the sector can withstand the ripple effects of tariffs and maintain its position in an increasingly competitive global market.

Fishing for answers: How tariffs could sink UK seafood exports

The UK fishing and shellfish industry generates significant revenue from exports, with the US serving as a key market. In the year through June 2024, the UK exported 477,000 tonnes of fish, with 12.8% of these exports—worth just over £250 million—heading to the US. High-demand products like Scottish salmon and North Sea cod are the primary drivers of this trade.

However, the introduction of a general tariff under President Trump's new policy could severely impact these exports, making them less competitive and reducing demand in this essential market. Some estimates suggest that US tariffs could trigger a 21.5% drop in the industry’s global export value. While 2022 data was used for these simulations, the potential consequences remain alarming for fishing companies.

Such a significant decrease in global export value could ripple throughout the entire supply chain, affecting not only fishing companies but also packaging firms, transportation services, and local economies reliant on the industry. Marine fishing companies in the UK are estimated to have a profit margin of 6-7% in 2024-25, indicating that many fishing companies would not survive an extended period with reduced demand. Additionally, these tariffs could disrupt long-standing trade relationships, forcing companies to seek alternative markets or partners, a process that can be both costly and time-consuming. The broader economic implications emphasize the need for careful consideration of tariff policies and their potential unintended consequences.

UK mining faces a rocky road under new US trade policies

The UK mining sector, while smaller than global giants, remains vital for extracting key resources such as precious metals, non-ferrous metals, industrial minerals, and aggregates used across diverse industries. In 2022, the UK produced minerals worth approximately £45.5 billion, while the global industry reached around £1,470 billion, making the UK market 3.1% of the global total. However, Trump’s proposed tariffs on UK imports are expected to add significant export challenges for the sector. According to the CITP, the UK mining sector could see a 20.4% drop in global exports and an 11.6% decline in mining services exports, highlighting major concerns.

During Trump’s first term, tariffs on steel and aluminium caused global price volatility, reducing export competitiveness and disrupting supply chains. In response, UK mining companies shifted focus to alternative markets like the EU and Asia while industry groups lobbied for exemptions to reduce the fallout. Although a tariff-free agreement on UK steel and aluminium exports was reached in 2022, it came too late to offset earlier losses.

To address these renewed challenges, mining companies must target high-growth regions such as the EU and Asia, which offer significant opportunities as the US accounts for only 10% of the UK sector’s trade. Additionally, focusing on value-added processing—refining raw materials into higher-value products domestically—could reduce reliance on raw material exports. This approach would expand access to global markets, potentially qualify for reduced tariff rates under specific trade agreements and strengthen export competitiveness in an increasingly protectionist economy.

Adapting to changing tariffs: Key success factors

Adapting to tariff changes requires a multifaceted approach that combines strategic planning, market diversification, and operational adjustments. There are several key success factors that can help businesses navigate the challenges posed by tariff changes.

Relocate and invest in target markets

Establishing manufacturing operations in key markets, such as the US, can help businesses bypass tariffs and strengthen their local presence. By aligning investments with market priorities, firms not only maintain competitive access but also enjoy the benefits of localized production, such as reduced logistics costs, faster delivery times, and stronger relationships with regional partners. Additionally, proximity to customers can enhance adaptability to market demands and trends.

Diversify export markets

Expanding reach beyond traditional markets can cushion the impact of tariffs and open up new revenue streams. Regions like the EU, Asia, and emerging economies present significant opportunities for growth, thanks to expanding middle classes and increasing demand for high-quality imports. Businesses can leverage trade associations and industry networks to advocate for streamlined regulations, reduced tariffs, and improved market access. Building relationships with local distributors and understanding cultural nuances are also vital steps in successfully entering new markets.

Diversify supplier networks

Reducing dependency on single suppliers located in high-tariff regions is crucial for supply chain resilience. By establishing alternative sourcing relationships, particularly in countries less impacted by tariffs or with favourable trade agreements, businesses can minimize disruptions and lower costs. This approach also reduces the risk of over-reliance on one region, ensuring a more stable supply chain during times of geopolitical tension or economic fluctuation. Long-term partnerships with multiple suppliers can also improve bargaining power and create more flexible procurement options.

Focus on value-added products

Shifting focus to higher-value products, such as luxury goods, advanced technologies, or unique, hard-to-replicate offerings, allows businesses to better absorb tariffs without compromising profitability. Customers of premium products often remain loyal despite slight price increases, provided the perceived value remains high. By investing in innovation, branding, and superior quality, businesses can stand out in the marketplace. Additionally, focusing on value-added products can open doors to niche markets where competition is less driven by price and more by differentiation.

Build strong customer relationships

In times of trade uncertainty, maintaining strong relationships with customers becomes even more important. Businesses can focus on offering high-quality customer service, loyalty programs, and consistent communication to retain their customer base. Educating customers about the reasons behind price adjustments, when necessary, can also foster understanding and trust. Strong relationships help businesses weather the challenges of competitive markets and shifting costs.

Final Word

President Trump’s tariff policies are expected to send shockwaves through the global economy. In response to higher tariffs, investors are likely to turn to the US dollar, driven by a reduced supply of dollars in the global economy due to lower US imports. According to NIESR, the GBP could depreciate by 10-15% in the coming years, leading to higher UK import prices and rising domestic inflation. While retaliatory tariffs could soften the blow, such measures come with significant risks and must be carefully considered.

The UK, however, is not among the countries most exposed to these tariffs, with major exporters like Germany likely to feel the brunt of the impact. Nevertheless, it is crucial for the UK to engage proactively with the US to reach agreements that minimize the economic fallout and benefit both sides. Chancellor Rachel Reeves has vowed to make “strong representations” to the Trump administration, advocating for the importance of free trade.

The introduction of these US tariffs is also likely to intensify the UK government’s resolve to improve relations with the EU. Chancellor Rachel Reeves stated in November 2024 that the UK needs to “reset our relationship” with Europe, emphasizing the interconnected nature of their markets.

UK industries most affected by these tariffs must remain vigilant in the months ahead and prepare contingency plans to navigate what could be a challenging period.