IBISWorld Platform

Answer any industry question in minutes with our entire database at your fingertips.

The Fertility Clinics industry assists patients with difficulty or who cannot conceive naturally. The sector includes numerous treatment options, the most popular being in-vitro fertilisation (IVF) cycles. Fertility Clinic revenue is expected to rise at a compound annual rate of 11.6% over the five years through 2025-26. In 2025-26, revenue is expected to inch up 13% to £505 million, with the average profit margin set to reach 23%.Incidences of infertility have supported growth, with around 9% to 15% of couples will have fertility problems, according to the British Fertility Society. Changing societal norms and acceptance of different people have been instrumental to fertility clinics. Women are delaying having children thanks to continued higher education, extended workforce participation and an emphasis on financial security. For generations, having children was viewed as a milestone reserved for married, heterosexual couples, but thankfully, social attitudes have since evolved, and we're witnessing a rise in the number of LGBTQI+ couples wanting children, as well as shifting attitudes towards single parenthood. However, fertility clinics contend with challenges, including falling NHS funding, strained finances and the clampdown on add-ons and opaque fees under new CMA powers threatens high-margin upsells. Clinics are moving toward transparent pricing, standardised fee schedules, and evidence-based interventions. Larger groups invest in trials to validate selected technologies, while all face growing pressure to compete on value, access, and trust.Fertility Clinic revenue is expected to grow at a compound annual rate of 4.3% to £624.2 million over the five years through 2030-31, while the average profit margin is estimated to remain stable at 23.1%. The industry continues to contend with tightening public funding. Nonetheless, growth opportunities remain. Infertility rates are forecast to continue rising, and clinics are well positioned to benefit from the changing demographics and social trends, like greater female workforce participation, LGBTQI+ couples and single parents. Changing attitudes towards fertility benefits in the workplace are also anticipated to support treatments. Rapid advances in AI embryo selection, genetic testing and cryopreservation promise higher success rates, boosting uptake but raising cost gaps between premium and basic providers. Frontier science - womb transplants, embryo implantation research and synthetic embryos - could open new patient pathways, though regulation lags. Meanwhile, stalled surrogacy reform pushes families abroad, limiting domestic clinics’ role in this growing market. Clinics must balance innovation with transparent pricing, ethical governance and inclusive services to sustain growth and patient trust.

Answer any industry question in minutes with our entire database at your fingertips.

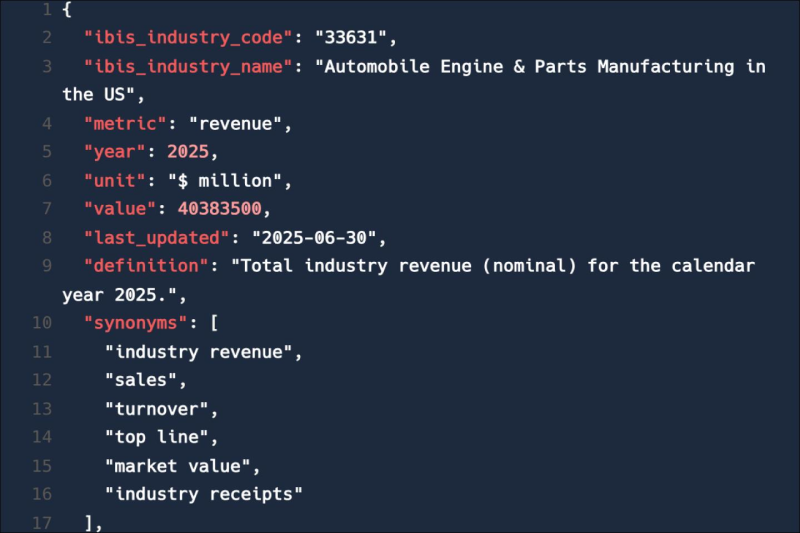

Feed trusted, human-driven industry intelligence straight into your platform.

Streamline your workflow with IBISWorld’s intelligence built into your toolkit.

IBISWorld's research coverage on the Fertility Clinics industry in the United Kingdom includes market sizing, forecasting, data and analysis from 2015-2030. The most recent publication was released September 2025.

The Fertility Clinics industry in the United Kingdom operates under the SIC industry code SP0.297. Fertility clinics are medical clinics that assist individuals and couples who want to become parents but for medical reasons have been unable to achieve this goal via the natural course. Related terms covered in the Fertility Clinics industry in the United Kingdom include in vitro fertilisation (ivf), egg freezing, pre-implantation genetic diagnosis or testing (pgd) and gene therapy.

Products and services covered in Fertility Clinics industry in the United Kingdom include IVF fertility treatment cycles, Other fertility treatment cycles and Egg, sperm and embryo freezing, thawing and transfers.

Companies covered in the Fertility Clinics industry in the United Kingdom include Care Fertility Group Ltd, TFP Fertility Holding Ltd and London Women's Clinic Ltd.

The Performance chapter covers detailed analysis, datasets, detailed current performance, sources of volatility and an outlook with forecasts for the Fertility Clinics industry in the United Kingdom.

Questions answered in this chapter include what's driving current industry performance, what influences industry volatility, how do successful businesses overcome volatility, what's driving the industry outlook. This analysis is supported with data and statistics on industry revenues, costs, profits, businesses and employees.

The Products and Markets chapter covers detailed products and service segmentation and analysis of major markets for the for the Fertility Clinics industry in the United Kingdom.

Questions answered in this chapter include how are the industry's products and services performing, what are innovations in industry products and services, what products or services do successful businesses offer and what's influencing demand from the industry's markets. This includes data and statistics on industry revenues by product and service segmentation and major markets.

The Geographic Breakdown chapter covers detailed analysis and datasets on regional performance of the Fertility Clinics industry in the United Kingdom.

Questions answered in this chapter include where are industry businesses located and how do businesses use location to their advantage. This includes data and statistics on industry revenues by location.

The Competitive Forces chapter covers the concentration, barriers to entry and supplier and buyer profiles in the Fertility Clinics industry in the United Kingdom. This includes data and statistics on industry market share concentration, barriers to entry, substitute products and buyer & supplier power.

Questions answered in this chapter include what impacts the industry's market share concentration, how do successful businesses handle concentration, what challenges do potential industry entrants face, how can potential entrants overcome barriers to entry, what are substitutes for industry services, how do successful businesses compete with substitutes and what power do buyers and suppliers have over the industry and how do successful businesses manage buyer & supplier power.

The Companies chapter covers Key Takeaways, Market Share and Companies in the Fertility Clinics industry in the United Kingdom. This includes data and analysis on companies operating in the industry that hold a market share greater than 5%.

Questions answered in this chapter include what companies have a meaningful market share and how each company is performing.

The External Environment chapter covers Key Takeaways, External Drivers, Regulation & Policy and Assistance in the Fertility Clinics industry in the United Kingdom. This includes data and statistics on factors impacting industry revenue such as economic indicators, regulation, policy and assistance programs.

Questions answered in this chapter include what demographic and macroeconomic factors impact the industry, what regulations impact the industry, what assistance is available to this industry.

The Financial Benchmarks chapter covers Key Takeaways, Cost Structure, Financial Ratios, Valuation Multiples and Key Ratios in the Fertility Clinics industry in the United Kingdom. This includes financial data and statistics on industry performance including key cost inputs, profitability, key financial ratios and enterprise value multiples.

Questions answered in this chapter include what trends impact industry costs and how financial ratios have changed overtime.

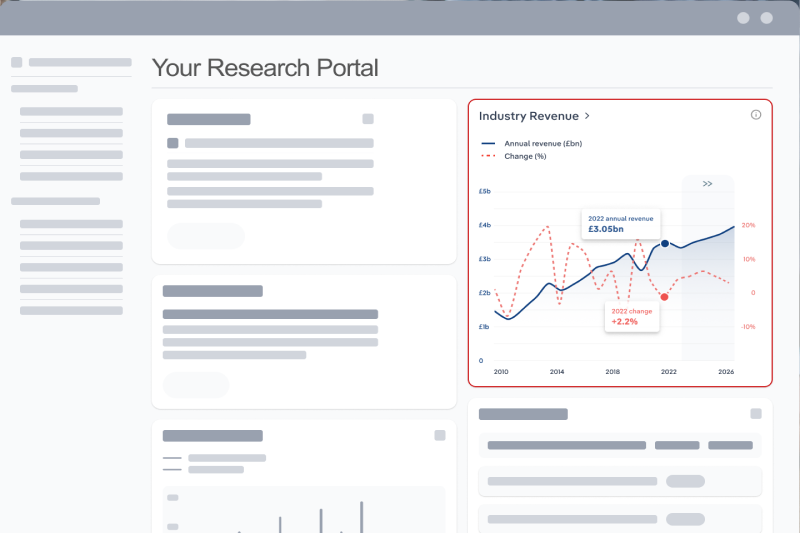

The Industry Data chapter includes 10 years of historical data with 5 years of forecast data covering statistics like revenue, industry value add, establishments, enterprises, employment and wages in the Fertility Clinics industry in the United Kingdom.

More than 6,000 businesses use IBISWorld to shape local and global economies

We were able to supplement our reports with IBISWorld’s information from both a qualitative and quantitative standpoint. All of our reporting now features some level of IBISWorld integration.

IBISWorld delivers the crisp business knowledge we need to drive our business. Whether it be serving up our major clients, winning new business or educating on industry issues, IBISWorld brings real value.

IBISWorld has revolutionised business information — which has proved commercially invaluable to exporters, investors and public policy professionals in Australia and overseas.

When you’re able to speak to clients and be knowledgeable about what they do and the state that they operate in, they’re going to trust you a lot more.

The market size of the Fertility Clinics industry in the United Kingdom is £523.9m in 2026.

There are 80 businesses in the Fertility Clinics industry in the United Kingdom, which has grown at a CAGR of 0.5 % between 2020 and 2025.

The Fertility Clinics industry in the United Kingdom is unlikely to be materially impacted by import tariffs with imports accounting for a low share of industry revenue.

The Fertility Clinics industry in the United Kingdom is unlikely to be materially impacted by export tariffs with exports accounting for a low share of industry revenue.

The market size of the Fertility Clinics industry in the United Kingdom has been growing at a CAGR of 7.0 % between 2020 and 2025.

Over the next five years, the Fertility Clinics industry in the United Kingdom is expected to grow.

The biggest companies operating in the Fertility Clinics industry in the United Kingdom are Care Fertility Group Ltd, TFP Fertility Holding Ltd and London Women's Clinic Ltd

IVF treatment cycles and Other fertility treatment cycles are part of the Fertility Clinics industry in the United Kingdom.

The company holding the most market share in the Fertility Clinics industry in the United Kingdom is Care Fertility Group Ltd.

The level of competition is moderate and steady in the Fertility Clinics industry in the United Kingdom.